We��ve been bullish on the residential construction sector for several years now. We still are, even though interest rates and mortgage rates are rising. However, Trump��s escalating trade war (skirmishes?) and a tightening labor market are introducing new risks to our homebuilder stock thesis. We still think the residential construction market will remain strong but it could be prudent for investors to diversify. We��ve already reduced our position in builder D.R. Horton (NYSE:DHI) and added a position in an HVAC company Lennox International (NYSE:LII). We think Sherwin-Williams (NYSE:SHW) also could make a great candidate for further inclusion into our residential construction bucket of stocks.

Why Sherwin-Williams?Sherwin-Williams has two attributes that make it attractive for diversification purposes.

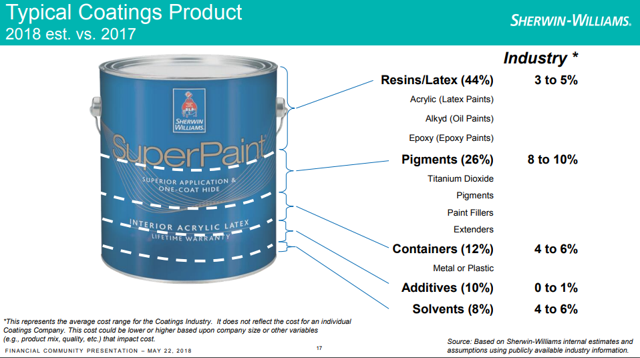

First, it��s cost inputs are very different then homebuilders and HVAC manufacturers. Labor and lumber costs are two of the biggest input costs (excluding land) for the price of new homes. For HVAC companies steel, aluminum, copper, motors and compressors, and electrical control components are some of the biggest cost inputs. Lumber, steel, and aluminum have been recently affected by tariffs.

In contrast, the biggest input costs for Sherwin-Williams are chemicals such as titanium dioxide and various hydrocarbons and acrylic polymers that make up the components of paint.

(Source: Investor presentation)

As a company that sells paint vs. doing the actual painting, the company also is insulated from labor costs to some degree. Yes, the company does operate retail stores, so there would be some potential for increased costs for retail associates. But producing paint is not as labor intensive as building a house.

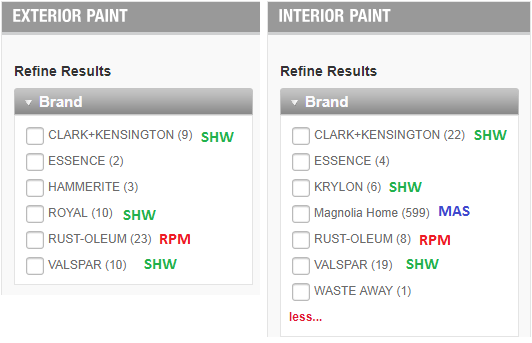

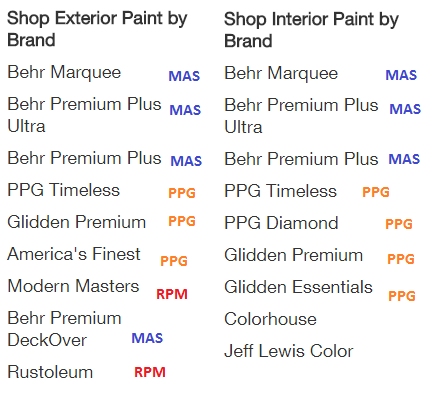

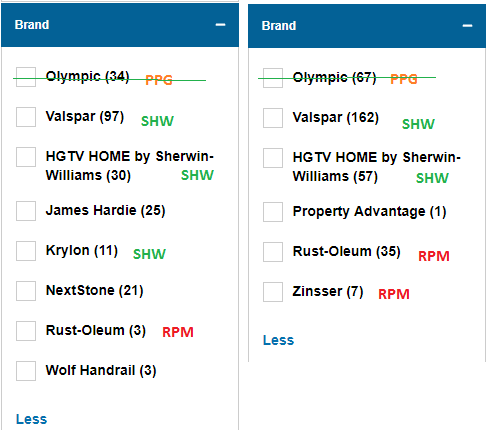

The second thing Sherwin-Williams has going for it is that while the coatings industry is highly fragmented, the various sub industries are not. When it comes to traditional architectural coatings (or ��house paint��) there are four to five major players �� Benjamin Moore (NYSE:BRK.B), PPG Industries (NYSE:PPG), Masco (NYSE:MAS), Sherwin-Williams, and perhaps RPM International (NYSE:RPM). Not only that but the retail market is even more consolidated. The typical big box hardware store carries just one or two major brands of paint. We looked at the paint carried by the three major hardware store chains �� Lowe's (NYSE:LOW), Home Depot (NYSE:HD), and Ace Hardware. The graphics below are screen shots of the interior and exterior home paint brands each chain offers. We added paint company next to each brand.

Below is Ace Hardware. For exterior paint they offer mainly Sherwin-Williams owned or produced products with some RPM. For interior, it��s mainly Masco along with some Sherwin-Williams and RPM.

Home Depot is mainly a PPG and Masco store.

Lowe��s signed an exclusivity agreement with Sherwin-Williams so all PPG paint will eventually be phased out (which is why we crossed it out in the graphic below).

There is some RPM paint sold but all of those are quart-sized products designed for metal and other surfaces. Additionally, some of the other brands you see such as James Hardie or NextStone are specialty paint products designed for very specific applications.

We can see that although the coatings industry in aggregate is fragmented, individual submarkets have consolidated significantly and companies have carved up the third-party retail space between themselves. This makes it likely that the paint companies have the ability to raise prices should input costs start to rise.

Also, when it comes to painting the actual cost of the product makes up a very small portion of the total overall cost of painting something. A majority of the cost is labor. Thus, increases in paint prices will not have a significant impact on the cost of painting in most cases.

Sherwin-Williams checks all the boxes for diversification. Its cost exposure is significantly different than other building products companies or homebuilders. It��s also not de-worsification as the architectural coatings industry is fairly consolidated and margins and returns on capital should be good. The only caveat is the stock��s valuation.

ValuationSherwin-Williams has been range bound for about the last eight months or so but is still trading at almost 22 times forward earnings.

Using a reverse DCF model with a 10% discount rate, short-term, high-growth period of five years, and a terminal growth rate of 3% the current stock price is implying 16.3% growth over the next five years. Right now analysis consensus growth estimates are 15.33%.

However, the company is currently in the midst of integrating the Valspar acquisition and is projecting some additional margin and synergy benefits. If we project an additional 1% increase in gross margins the five-year implied growth rate drops to about 11%. If we add in the additional synergies and better FCF conversion for a total of $150M in additional FCF the implied five year growth rate drops further to about 9.2%.

Sherwin-Williams certainly is cheap but we think a case could be made that the stock is close to fairly priced, especially considering it��s reasonable to pay a premium for a company that derives a majority of its net income (81%) from a highly consolidated industry.

Disclosure: I am/we are long DHI, LII.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: We may initiate a long position in SHW in the next 72 hours or more. We are also long UTX which has an HVAC business.

No comments:

Post a Comment