Friday, May 31, 2013

Thursday, May 30, 2013

Why Avago Shares Accelerated

Although we don't believe in timing the market or panicking over market movements, we do like to keep an eye on big changes -- just in case they're material to our investing thesis.

What: Shares of Avago Technologies (NASDAQ: AVGO ) have gained 10% today after the company reported strong earnings following Wednesday's market close. Shares have also been buoyed by increasing analyst optimism for the company, particularly after Avago raised its guidance.

So what: Avago's second-quarter revenue of $562 million and net income of $0.61 per share both bested Wall Street's expectations, which had sought $557 million and $0.58 per share. The company boosted its revenue guidance range for the current quarter to $596 million to $613 million, which on the high end is well above Wall Street's $600 million consensus.

Now what: Some analysts reiterated their bullish outlooks after the report. Deutsche Bank's Ross Seymore raised his his fiscal-year EPS expectations and raised his price target from $40 to $45 per share. RBC Capital reiterated a buy rating, as did HighPeaks Analytics' JoAnne Feeney and Lazard Capital Markets' Ian Ing, whose price target matches Seymore's. These analysts are generally expecting nearly 20% upside left, which is a pretty solid gain and worth investigating, particularly as Avago's valuation remains attractive even after its pop.

Want more news and updates? Add Avago Technologies to your watchlist now.

It's incredible to think just how much of our digital and technological lives are almost entirely shaped and molded by just a handful of companies. Find out "Who Will Win the War Between the 5 Biggest Tech Stocks?" in The Motley Fool's latest free report, which details the knock-down, drag-out battle being waged by the five kings of tech. Click here to keep reading.

Wednesday, May 29, 2013

Hot Shipping Companies To Watch For 2014

Although we don't believe in timing the market or panicking over market movements, we do like to keep an eye on big changes -- just in case they're material to our investing thesis.

What: Shares of shipping company Navios Maritime (NYSE: NM ) jumped as much as 14% today after the company released earnings.

So what: Revenue fell 12% from a year ago to $133.8 million, but it easily topped the $97.1 million estimate. The company lost $0.10 per share, but that was well ahead of the expected $0.22 loss, and that got investors excited today. �

Now what: The dry-bulk segment was hit hardest over the past year, and rates fell 45% to $11,820 per day. There's a long history of challenges in this segment, and it doesn't appear to be getting any better, with oversupply in the industry. Today's results may have beaten expectations, but I'm not a buyer, because the company's still seeing deteriorating results.

Interested in more info on Navios Maritime? Add it to your watchlist by clicking here.

Hot Shipping Companies To Watch For 2014: Convergys Corporation (CVG)

Convergys Corporation provides relationship management solutions in North America and internationally. Its Customer Management segment offers agent-assisted, self-service, and intelligent technology care solutions, including customer service, customer retention, sales, technical support, social interaction, collections management, back office, business-to-business, customer experience applied analytics, and intelligent interaction solutions for communications, financial services, technology, retail, healthcare, and government markets. This segment also provides premise-based and hosted automated self-care and technology solutions; speech recognition solutions; and license, professional, consulting and maintenance, and software support services. Convergys Corporation was founded in 1998 and is headquartered in Cincinnati, Ohio.

Hot Shipping Companies To Watch For 2014: Digital Ally Inc.(DGLY)

Digital Ally, Inc. engages in the production and sale of digital video imaging, audio/video recording, storage, and other products for use in law enforcement and security applications. Its digital audio/video recording and storage product line comprises an in-car digital audio/video system that is integrated into a rear view mirror; an all-weather mobile digital audio/video system designed for motorcycle, ATV, and boat uses; a miniature body-worn digital audio/video camera; a hand-held speed detection system based on light detection and ranging (LIDAR); a hand-held thermal imaging camera used for improved night vision; and a digital audio/video system, which is integrated into a law-enforcement style flashlight. The company?s products make self-contained video and audio recordings onto flash memory cards that are incorporated in the body of the digital video rear view mirror, officer-worn video, and audio system and flashlight. Digital Ally, Inc. sells its products to law enforcement agencies and other security organizations, as well as for consumer and commercial applications through direct sales and third-party distributors. The company is based in Overland Park, Kansas.

Hot Promising Stocks For 2014: Teekay Offshore Partners L.P.(TOO)

Teekay Offshore Partners L.P. provides marine transportation, oil production, and storage services to the offshore oil industry. It operates shuttle tankers, floating storage and offtake (FSO) units, and conventional crude oil tankers, as well as floating production, storage, and offloading (FPSO) units. As of June 30, 2011, its fleet consisted of 40 shuttle tankers, including 5 chartered-in vessels and 4 committed newbuildings; 2 FPSO units; 5 FSO units; and 10 conventional oil tankers. The company primarily serves energy and oil service companies, and their affiliates. Teekay Offshore GP L.L.C. serves as the general partner of the company. The company was founded in 2006 and is headquartered in Hamilton, Bermuda.

Hot Shipping Companies To Watch For 2014: King Solomon Mines Ltd (KSO.AX)

King Solomon Mines Limited, through its subsidiaries, engages in the acquisition, exploration, and development of mineral resource properties in China. It primarily explores for gold, copper, and other metallic deposits. The company�s properties located in the Sonid Zuoqi county, Inner Mongolia include the Marmot copper�molybdenum�gold project that covers an area of 39.7 square kilometers; Sonid North gold project covering an area of 24.8 square kilometers; and Naogaoshandu gold project, which covers an area of 47.2 square kilometers. It also holds interest in Bu Dun Hua porphyry copper�molybdenum project covering an area of 25.1 square kilometers in the Wengniute County, Inner Mongolia. The company was founded in 2003 and is based in Auckland, New Zealand.

Hot Shipping Companies To Watch For 2014: Nanosonics Ltd(NAN.AX)

Nanosonics Limited engages in the research, development, and commercialization of infection control and decontamination products, and related technologies in Australia and Europe. The company manufactures and distributes Trophon EPR ultrasound probe disinfector, as well as associated consumables. It also owns intellectual properties relating to disinfection and sterilization technologies. The company offers its products and services to healthcare, food processing, room and space decontamination, and manufacturing industries. Nanosonics Limited was founded in 2000 and is headquartered in Alexandria, Australia.

Tuesday, May 28, 2013

Tiffany's Surprise

The following video is from Tuesday's Investor Beat, in which host Chris Hill and analysts Jason Moser and Matt Koppenheffer dissect the hardest-hitting investing stories of the day.

Shares of Tiffany (NYSE: TIF ) shine after the jeweler reports higher-than-expected quarterly earnings. Same-store sales were up 20% in Japan and 8% overall. Shares of the luxury retailer hit an all-time high on the news. In this installment of Investor Beat, our analysts weigh the merits of investing in Tiffany.

The retail space is in the midst of the biggest paradigm shift since mail order took off at the turn of the last century. Only those most forward-looking and capable companies will survive, and they'll handsomely reward those investors who understand the landscape. You can read about the 3 Companies Ready to Rule Retail in The Motley Fool's special report. Uncovering these top picks is free today; just click here to read more.

The relevant video segment can be found between 0:19 and 2:48.

Energy Investors Are About to Have More Income Opportunities

For investors in search of high yields, master limited partnerships have been the place to go. This unique business structure has been especially appealing to midstream oil and gas companies. With stable, predictable cash flows that aren't as affected by commodity prices as other parts of the oil and gas industry, midstream companies are able to return big sums of cash to shareholders. The business structure is so popular that several larger companies are looking to spin off their midstream assets into MLPs.

This past quarter, Phillips 66 (NYSE: PSX ) , Valero (NYSE: VLO ) , and Devon Energy (NYSE: DVN ) have each expressed interest in a midstream MLP spin-off, and some expect to finish the process by the end of the year. In this video, Fool.com contributor Tyler Crowe looks at what these new midstream companies will mean to the MLP space and how investors should digest the news.

The growing production of natural gas from hydraulic fracturing and horizontal drilling is flooding the North American market and resulting in record-low prices for natural gas. Enterprise Products Partners, with its superior integrated asset base, can profit from the massive bottlenecks in takeaway capacity by taking on large-scale projects. To help investors decide whether Enterprise Products Partners is a buy or a sell today, click here now to check out The Motley Fool's brand-new premium research report on the company.

Monday, May 27, 2013

Lockheed Wins Contracts for Anti-Submarine Warfare, Anti-Missile Defense

The Department of Defense handed out 20 new defense contracts on Monday, awarding $717.7 million in total. Surprisingly, one single firm captured 20% of the contracts on offer: Lockheed Martin (NYSE: LMT ) .

In a series of four wins, Lockheed secured contracts worth:

$111.5 million: for the firm's Mission Systems and Training (MST) division, in the form of a cost-plus-incentive-fee, cost-only, firm-fixed-price contract for the development, integration and production of AN/SQQ-89A(V)15 Surface Ship Undersea Warfare Systems. This system enables a surface warship to search, detect, classify, localize and track undersea contacts, and to engage and evade submarines, mine-like small objects and torpedo threats. Lockheed will perform the work under a foreign military sales contract benefiting the Japan Self-Defense Force with a May 2014 completion date. $29.7 million: also for MST, in the form of a sole-source, cost-plus-incentive-fee/cost-plus-award-fee contract modification for post-certification support of the Aegis Ballistic Missile Defense baselines 4.0.X, 5.0 and 5.0 capability upgrade -- a project to turn Aegis into a ballistic missile defense system. This contract extension runs through Dec. 2014. $8.2 million: for the firm's Missile and Fire Control division, in the form of a cost-plus-fixed-fee contract to supply Affordable Phased Array Sensor Systems to the U.S. Army. These sensors are specially designed to detect incoming missiles, helicopters, and unmanned aerial vehicles. $48.2 million: in a contract award shared among Lockheed Martin Services, ABM's (NYSE: ABM ) Government Services unit, LB&B Associates, J&J Maintenance, and EMCOR (NASDAQ: EMKR ) Government Services. This contract to provide engineering services to the U.S. Army Corps of Engineers is actually a modification of a previously awarded firm-fixed-price, multiple-award, task-order contract, and raises the ceiling value of the initial contract.Sunday, May 26, 2013

Dow May Open Flat After Friday's Record Close

LONDON -- Stock index futures at 7 a.m. EDT indicate that the Dow Jones Industrial Average (DJINDICES: ^DJI ) may open down by seven points this morning, while the S&P 500 (SNPINDEX: ^GSPC ) may open a single point lower. CNN's Fear & Greed Index has surged higher and currently sits at 91, suggesting that the bullish sentiment may be nearing a peak.

In London, markets opened strongly this morning, and the FTSE 100 is up 0.39% as of 7:30 a.m. EDT. Germany's DAX has continued its recent strong run, gaining a further 0.36%. Stock markets in the eurozone's recession-bound southern states all lost ground following weak economic data. In Greece, new data showed that industrial orders were down by 12.7% in March compared with the same period last year, while in Italy, industrial orders were down by 10% on a year-on-year basis. Greece's Athens Stock Exchange General Index is down 3% at the time of writing, while Italy's FTSE MIB is down by 0.8%.

U.S. trading may start slowly, as there are no major economic reports due this morning and the earnings calendar is nearly empty. Companies that are scheduled to provide quarterly updates include Campbell Soup, which is expected to report earnings of $0.56 per share before markets open this morning. Should Campbell Soup disappoint investors, its shares could be heavily traded, as the firm's stock has risen by 36% so far this year to outperform its peers. Campbell is also expected to provide updated guidance today -- it has previously projected earnings of between $2.51 and $2.57 for the 2013 fiscal year.

Other stocks that may be actively traded today include Qihoo 360 Technology. The Chinese Internet security firm reported quarterly earnings of $0.14 per share earlier this morning, beating consensus forecasts of $0.13 per share. Qihoo's revenue was up 58% compared with the same period last year, also beating expectations, and the firm has updated its second-quarter guidance to between $142 million and $144 million. Later today, TiVo is due to report its latest quarterly earnings, as are Urban Outfitters, Guess, and Big Lots.

Yahoo! stock is 2% higher in premarket trading this morning following reports that the Internet giant is about to buy blogging site Tumblr for $1.1 billion, although neither company had confirmed the deal at the time of writing.

Finally, let's not forget that the Dow's daily movements can add up to some serious long-term gains. Indeed, Warren Buffett recently wrote: "The Dow advanced from 66 to 11,497 in the 20th Century, a staggering 17,320% increase that materialized despite four costly wars, a Great Depression and many recessions." If you, like Buffett, are convinced of the long-term power of the Dow, you should read "5 Stocks To Retire On." Your long-term wealth could be transformed, even in this uncertain economy. Simply click here now to download this free, no-obligation report.

Saturday, May 25, 2013

Top 5 Income Companies To Own For 2014

Although business headlines still tout earnings numbers, many investors have moved past net earnings as a measure of a company's economic output. That's because earnings are very often less trustworthy than cash flow, since earnings are more open to manipulation based on dubious judgment calls.

Earnings' unreliability is one of the reasons Foolish investors often flip straight past the income statement to check the cash flow statement. In general, by taking a close look at the cash moving in and out of the business, you can better understand whether the last batch of earnings brought money into the company, or merely disguised a cash gusher with a pretty headline.

Calling all cash flows

When you are trying to buy the market's best stocks, it's worth checking up on your companies' free cash flow once a quarter or so, to see whether it bears any relationship to the net income in the headlines. That's what we do with this series. Today, we're checking in on Emeritus (NYSE: ESC ) , whose recent revenue and earnings are plotted below.

Top 5 Income Companies To Own For 2014: Triangle Capital Corporation (TCAP)

Triangle Capital Corporation is a private equity and venture capital firm specializing in leveraged buyouts, management buyouts, ESOPs, change of control transactions, acquisition financings, growth financing, and recapitalizations in lower middle market companies. The firm prefers to make investments in many business sectors including manufacturing, distribution, transportation, energy, communications, health services, restaurants, media, and others. It primarily invests in companies located throughout the United States, with an emphasis on the Southeast and Midatlantic. The firm typically invests between $5 million and $20 million per transaction, in companies having annual revenues between $10 million and $200 million and an EBITDA between $3 million and $20 million and can also co-invest. It primarily invests in senior subordinated debt securities secured by second lien security interests in portfolio company assets, coupled with equity interests. The firm also invests in senior debt securities secured by first lien security interests in portfolio companies. Triangle Capital Corporation was founded in 2002 and is based in Raleigh, North Carolina.

Top 5 Income Companies To Own For 2014: Officemax Incorporated(OMX)

OfficeMax Incorporated, together with its subsidiaries, distributes business-to-business and retail office products. Its Contract segment markets and sells office supplies and paper, technology products and solutions, office furniture, and print and document services directly to large corporate and government offices, as well as to small and medium-sized offices through field salespeople, outbound telesales, catalogs, Internet, and office products stores. As of December 31, 2011, this segment operated 38 distribution centers in the United States, Puerto Rico, Canada, Australia, and New Zealand; 4 customer service and outbound telesales centers in the United States; and 47 office products stores in Canada, Hawaii, Australia, and New Zealand. The company?s Retail segment markets and sells office supplies and paper, print and document services, technology products and solutions, and office furniture to small and medium-sized businesses and consumers through a network of reta il stores. As of December 31, 2011, this segment operated 978 stores in the United States and Mexico; 3 large distribution centers in the United States; and 1 small distribution center in Mexico. The company, formerly known as Boise Cascade Corporation, was founded in 1913 and is headquartered in Naperville, Illinois.

Top Healthcare Technology Companies To Buy For 2014: Sharps Compliance Corp(SMED)

Sharps Compliance Corp. provides management solutions for medical waste, used healthcare materials, and unused dispensed medications in the United States. The company offers a range of product and service solutions, including sharps recovery system for the containment, transportation, treatment, and tracking of medical waste and used healthcare materials generated outside the hospital and health care facility settings. It also provides takeaway environmental return systems, complete needle collection and disposal systems, Rx takeaway recovery and reporting systems, sharps MWMS, takeaway recovery systems, and sharpstracer solutions. In addition, the company offers various other logistical solutions, such as pitch-it IV poles, trip lessystem, sharps pump and asset return boxes, sharps secure needle collection and containment systems, sharps recovery system needle collection and mailback disposal systems, isowash linen recovery systems, and biohazard spill clean-up kit and di sposal systems. It serves consumers in government, home health care, retail clinics and immunizing pharmacies, pharmaceutical manufacturers, professional offices, hospitality, commercial, industrial, and agriculture markets. Sharps Compliance Corp. was founded in 1992 and is headquartered in Houston, Texas.

Top 5 Income Companies To Own For 2014: Patriot Coal Corporation(PCX)

Patriot Coal Corporation engages in the mining, production, and sale of thermal coal primarily to electricity generators in the eastern United States. It has operations and coal reserves in the Appalachia and the Illinois Basin coal regions. The company is also involved in the production of metallurgical quality coal and sells it to steel mills and independent coke producers. As of December 31, 2011, Patriot Coal Corporation operated 11 active mining complexes in West Virginia; and 3 mining complexes in western Kentucky. In addition, it controlled approximately 1.9 billion tons of proven and probable coal reserves that comprise metallurgical coal and medium and high-Btu thermal coal, with low, medium, and high sulfur content. The company, through its subsidiary, Magnum Coal Company, operates eight mining complexes with production from surface and underground mines in Appalachia, as well as controls approximately 600 million tons of proven and probable coal reserves. Patrio t Coal Corporation is based in St. Louis, Missouri.

Top 5 Income Companies To Own For 2014: Key Energy Services Inc. (KEG)

Key Energy Services, Inc. operates as an onshore rig-based well servicing contractor in the United States and internationally. The company offers rig-based services, including the maintenance, workover, and recompletion of existing oil and gas wells; completion of newly-drilled wells; and plugging and abandonment of wells at the end of their lives, as well as specialty drilling services to oil and natural gas producers. It also provides fluid management services, such as vacuum truck services, fluid transportation services, and disposal services for operators, whose wells produce saltwater or other non-hydrocarbon fluids; and equipment trucks that are used to move large equipment from one well site to the next, as well as supplies frac tanks, which are used for temporary storage of fluids associated with fluid hauling operations. In addition, the company operates a fleet of hot oilers for pumping heated fluids that are used to clear soluble restrictions in a wellbore; and offers intervention services, such as coiled tubing, pumping, and nitrogen service. Further, it provides fishing services that involve recovering lost or stuck equipment in the wellbore utilizing an array of fishing tools; rental equipment comprising drill pipe, tubulars, pressure-control equipment, power swivels, and foam air units, as well as handling tools comprising Hydra-Walk pipe-handling units and services; oilfield service equipment controls, data acquisition, and digital information flow services; and drilling, project management, consulting, and reservoir engineering services. The company was formerly known as Key Energy Group, Inc. and changed its name to Key Energy Services, Inc. in December 1998. Key Energy Services, Inc. was founded in 1977 and is headquartered in Houston, Texas.

Friday, May 24, 2013

Best Oil Service Companies To Buy Right Now

Next Monday, Halliburton (NYSE: HAL ) will release its latest quarterly results. The key to making smart investment decisions on stocks reporting earnings is to anticipate how they'll do before they announce results, leaving you fully prepared to respond quickly to whatever inevitable surprises arise. That way, you'll be less likely to make an uninformed knee-jerk reaction to news that turns out to be exactly the wrong move.

Halliburton has thrived in the U.S. energy boom, but weak energy prices have raised questions about whether production activity will decline and cause a drop in demand for oil services. Let's take an early look at what's been happening with Halliburton over the past quarter and what we're likely to see in its quarterly report.

Stats on Halliburton

Best Oil Service Companies To Buy Right Now: Opko Health Inc(OPK)

OPKO Health, Inc., a pharmaceutical and diagnostics company, engages in the discovery, development, and commercialization of novel and proprietary technologies primarily in the United States, Chile, and Mexico. It provides a range of solutions, including molecular diagnostics tests, proprietary pharmaceuticals, and vaccines to diagnose, treat, and prevent neurological disorders, infectious diseases, oncology, and ophthalmologic diseases. The company offers molecular diagnostic platform technology for the rapid identification of molecules or immunobiomarkers; Alzheimer?s test for Alzheimer?s diagnostic; and protein-based influenza vaccines to provide multi-season and multi-strain protection against various influenza virus strains, such as seasonal influenza strains, as well as global influenza pandemic strains which include swine flu, and avian flu. It also offers Oligonucleotide Therapeutics for the treatment of various illnesses, including cancer, heart disease, metabolic disorders, and genetic anomalies; and oligosaccharide for asthma and chronic obstructive pulmonary diseases. In addition, the company provides Rolapitant, a potent and antagonist; neurokinin-1, which has completed Phase II clinical trials for prevention of chemotherapy induced nausea and vomiting, and post-operative induced nausea and vomiting; and SCH 900978 that has completed Phase II clinical trials for chronic cough. Further, it offers bevasiranib, a drug candidate for the treatment of Wet AMD; and develops Aquashunt, a shunt to be used in the treatment of glaucoma. Additionally, the company involves in the development, commercialization, and sale of ophthalmic diagnostic and imaging systems, and instrumentation products. OPKO Health, Inc. was founded in 2006 and is headquartered in Miami, Florida.

Advisors' Opinion:- [By Paul]

Opko Health Inc. Common Stock (AMEX:OPK): This equity had 12,313,459 shares sold short as of Aug 31st, as compared to 12,035,468 on Aug 15th, which represents a change of 277,991 shares, or 2.3%. Days to cover for this company is 14 and average daily trading volume is 858,491. About the equity: Opko Health, Inc. is a specialty pharmaceutical company that researches and develops pharmaceuticals. The Company researches treatments for macular degeneration and other ophthalmic diseases.

Best Oil Service Companies To Buy Right Now: Stokes(Australasia)

Stokes (Australasia) Limited engages in merchandising and distributing appliance parts, badges, medallions, electrical switches, and controls primarily in Australia. The company also manufactures electric elements and metal components for industrial and household products. It offers thermostats, heating elements, controls, cooking elements, industrial elements, and other electrical products. In addition, the company distributes spare parts for ovens, cook tops, washing machines, clothes dryers, vacuum cleaners, refrigerators, dishwashers, and microwave ovens, as well as for laundry, refrigeration, hot water, and dishwasher service and repair markets. Further, it distributes disposable dust bags, motors and carbon brushes, power heads, floor tools and accessories, hoses and accessories, extension rods, cloth bags and accessories, belts, brush strips and filters, repair and extension leads, switches and controls, immersion heaters, and vacuum cleaners. Additionally, the comp any manufactures and supplies badges, medallions, and trophies, as well as associated products, including school badges and bars, office bearer bars, name badges, custom badges, uniform buttons, badge fittings, medallions, and pendant medals. Stokes (Australasia) Limited was founded in 1856 and is based in West Ringwood, Australia.

Hot Bank Stocks For 2014: American Public Education Inc.(APEI)

American Public Education, Inc., together with its subsidiary, American Public University System, Inc., provides online postsecondary education focusing on the needs of the military and public service communities. The company operates through two universities, American Military University (AMU) and American Public University (APU) serving approximately 110,000 students in the United States and internationally. The universities share a common faculty and curriculum, which includes 87 degree programs and 69 certificate programs in disciplines related to national security, military studies, intelligence, homeland security, criminal justice, technology, business administration, education, nursing, and liberal arts. The company was founded in 1991 and is headquartered in Charles Town, West Virginia.

Best Oil Service Companies To Buy Right Now: Imris Inc He Company] (IM.TO)

IMRIS Inc. provides integrated image guided therapy solutions that deliver information to clinicians during surgical or interventional procedures in Canada, the United States, Europe, the Asia Pacific, and the Middle East. The company designs, manufactures, and markets VISIUS Surgical Theatre, a multifunctional surgical environment that incorporates magnetic resonance (MR) imaging, CT imaging, fluoroscopy, computed tomography, and x-ray angiography into multi-purpose surgical suites to provide intra-operative imaging for medical applications. It also provides ancillary products and services. The company�s solutions serve the neurosurgical, cerebrovascular, and cardiovascular markets worldwide. IMRIS Inc. is based in Winnipeg, Canada.

Thursday, May 23, 2013

Hot Communications Equipment Stocks To Watch Right Now

Once upon a time (near the end of the Internet Bubble), telecommunications equipment stocks were the bee's knees -- the most popular kids on the block. Today, however, many of these firms are just pale reflections of their former selves. One of yesteryear's favorites, for example, JDS Uniphase (NASDAQ: JDSU ) , once boasted a per-share price (split-adjusted) in excess of $1,050. Today, it costs a mere $13.28 -- down 98.75% from its peak.

And it's still not a buy. Here's why, in three short points:

JDS Uniphase stock is losing ground

When you stack up JDS Uniphase stock up against two of its rivals�-- Cisco Systems (NASDAQ: CSCO ) and Finisar (NASDAQ: FNSR ) , some interesting dynamics become apparent. First and foremost, of the three, JDS Uniphase stock is the only one �that has no P/E ratio ... because it has no "E" -- earnings -- to weigh its "P" -- price -- against.

Hot Communications Equipment Stocks To Watch Right Now: Clean Wind Energy Tower Inc (CWET)

Clean Wind Energy Tower, Inc. (Clean Wind), incorporated on January 22, 1962, focuses on becoming a provider of green energy. As of December 31, 2011, Clean Wind had designed and was preparing to develop, and construct Downdraft Towers that use non-toxic elements to generate electricity and clean water by integrating and synthesizing a range of proven, as well as emerging technologies.

The Downdraft Tower is a hollow cylinder with a water spray system at the top. Pumps deliver water to the top of the Downdraft Tower to spray a fine mist across the entire opening. The water evaporates and cools the hot dry air at the top. The cooled air is denser and heavier than the outside warmer air and falls through the cylinder at speeds up to and in excess of 50 miles per hour (mph), driving the turbines located at the base of the structure. The turbines power generators to produce electricity.

The Company competes with Southern California Edison Company, Pacific Gas & Electric Company, San Diego Gas & Electric Company, Arizona Public Service Company, Florida Power & Light Company, enXco, Inc., PPM Energy, Inc. and UNS.

Hot Communications Equipment Stocks To Watch Right Now: Yankee Hat Minerals Ltd.(KHT.V)

Yankee Hat Minerals Ltd. engages in the acquisition, exploration, and development of precious metal properties primarily in British Columbia and the Yukon, Canada. The company primarily explores for tungsten, rare earth element, gold, and copper. It holds interests in the Fran property located in the Omineca Mining District of British Columbia; the Kidlark, Lancer, and Selwyn properties located in Yukon Territory; and the Union property comprising 16 mineral claims located in the Greenwood mining division of British Columbia. The company was formerly known as Yankee Hat Industries Corp. and changed its name to Yankee Hat Minerals Ltd. in February 2005. Yankee Hat Minerals Ltd. is headquartered in Vancouver, Canada.

Top Sliver Companies To Invest In Right Now: Forest Oil Corporation (FST)

Forest Oil Corporation, an independent oil and gas company, engages in the acquisition, exploration, development, and production of oil, natural gas, and natural gas liquids in the United States. The company primarily has interests in the properties in the Texas Panhandle; the east Texas/north Louisiana; and the Eagle Ford Shale in south Texas. As of December 31, 2011, its total estimated proved oil and gas reserves were approximately 1,904 billion cubic feet equivalent. The company was founded in 1916 and is headquartered in Denver, Colorado with an additional office in Houston, Texas.

Wednesday, May 22, 2013

Under Armour Kicks It Old School

If you've ever lamented the day you had to give up your stylish 1990s workout gear, the creative minds at Under Armour (NYSE: UA ) have something awesome for you.

Melancholy athletes, meet the latest Charged Cotton gear from Under Armour, cut-off sweat shorts and all:

Source: Under Armour.

I don't know about you, but I personally had a couple of outfits just like this way back in the day, so this made me smile even as I paused to reflect on how much weight I've gained since then.

Old-school made new

Of course, while Under Armour has been selling clothes made from its Charged Cotton material since last year, the company only began showing off these "old-school" styles on its Facebook page yesterday afternoon.

True to form, they were also quick to remind consumers of their signature touches in the shorts' product description:

They're your old-school gym shorts -- that classic look and total comfort -- redesigned to work like today's cutting edge gear. These're made of ultra-soft Charged Cotton with an inner mesh layer that wicks sweat and speeds dry time.

All of a sudden, I find myself remembering one of the very reasons I hated my old cotton clothes: Every time I stepped out onto the basketball court or a football field, I was usually that guy. You know, the one who was absolutely dripping with sweat and, like everyone else at the time, wearing a cotton outfit that acted more like a disgusting, salty wet towel than anything else.

Perhaps unsurprisingly, that's also why Under Armour CEO Kevin Plank started the company in the first place. As the self-proclaimed "sweatiest guy on the football field" at the University of Maryland, Plank knew there was a better way, so he designed his first synthetic shirts for his teammates to wear.

Cotton is the frienemy

Then again, one of Under Armour's longtime slogans boldly declared "Cotton is the enemy" -- that is, until they realized their synthetic compression wear only represented four of the average 30 shirts in their customers' closets in 2011. That's when Under Armour found a way to interweave their synthetic moisture-wicking material with cotton fabric to form their Charged Cotton brand, a move some analysts said served to quadruple Under Armour's addressable market.

Sure enough, the move certainly hasn't hurt the young business, especially considering Under Armour has grown overall sales by at least 20% year over year for the past 12 consecutive quarters. What's more, apparel revenues have also risen at least 20% year over year for the past 14 quarters. Meanwhile, Under Armour stock has more than doubled over the same period.

Foolish final thoughts

While the introduction of this old-school style may seem relatively insignificant on the surface, these are exactly the kinds of moves Under Armour has proven so good at utilizing to broaden its reach and win the affections of an increasing number of consumers every day.

In the end, it's yet another one of many reasons I plan to hold on to my shares of Under Armour for a very, very long time.

More expert advice from The Motley Fool

In the world of sportswear retail, lululemon athletica is also a strong player, with a solid presence in the yogawear market. Lululemon has the potential to grow its sales by 10 times if it can penetrate its other markets like it has in Canada, but the competitive landscape is starting to increase. Can Lululemon fight off larger retailers and ultimately deliver huge profits for savvy investors? The Motley Fool answers these questions and more in its most in-depth Lululemon research available. Thousands have already claimed their own premium ticker coverage; gain instant access to your own by clicking here now.

.

Tuesday, May 21, 2013

Why Plains All American Pipeline's Earnings May Not Be So Hot

Although business headlines still tout earnings numbers, many investors have moved past net earnings as a measure of a company's economic output. That's because earnings are very often less trustworthy than cash flow, since earnings are more open to manipulation based on dubious judgment calls.

Earnings' unreliability is one of the reasons Foolish investors often flip straight past the income statement to check the cash flow statement. In general, by taking a close look at the cash moving in and out of the business, you can better understand whether the last batch of earnings brought money into the company, or merely disguised a cash gusher with a pretty headline.

Calling all cash flows

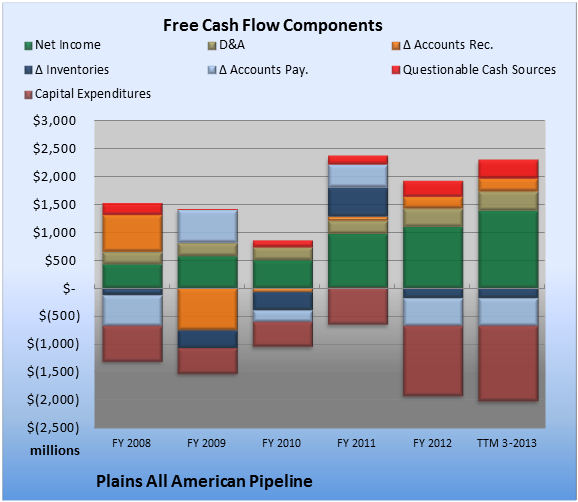

When you are trying to buy the market's best stocks, it's worth checking up on your companies' free cash flow once a quarter or so, to see whether it bears any relationship to the net income in the headlines. That's what we do with this series. Today, we're checking in on Plains All American Pipeline (NYSE: PAA ) , whose recent revenue and earnings are plotted below.

Source: S&P Capital IQ. Data is current as of last fully reported fiscal quarter. Dollar values in millions. FCF = free cash flow. FY = fiscal year. TTM = trailing 12 months.

Over the past 12 months, Plains All American Pipeline generated $558.0 million cash while it booked net income of $1,392.0 million. That means it turned 1.4% of its revenue into FCF. That doesn't sound so great. FCF is less than net income. Ideally, we'd like to see the opposite.

All cash is not equal

Unfortunately, the cash flow statement isn't immune from nonsense, either. That's why it pays to take a close look at the components of cash flow from operations, to make sure that the cash flows are of high quality. What does that mean? To me, it means they need to be real and replicable in the upcoming quarters, rather than being offset by continual cash outflows that don't appear on the income statement (such as major capital expenditures).

For instance, cash flow based on cash net income and adjustments for non-cash income-statement expenses (like depreciation) is generally favorable. An increase in cash flow based on stiffing your suppliers (by increasing accounts payable for the short term) or shortchanging Uncle Sam on taxes will come back to bite investors later. The same goes for decreasing accounts receivable; this is good to see, but it's ordinary in recessionary times, and you can only increase collections so much. Finally, adding stock-based compensation expense back to cash flows is questionable when a company hands out a lot of equity to employees and uses cash in later periods to buy back those shares.

So how does the cash flow at Plains All American Pipeline look? Take a peek at the chart below, which flags questionable cash flow sources with a red bar.

Source: S&P Capital IQ. Data is current as of last fully reported fiscal quarter. Dollar values in millions. TTM = trailing 12 months.

When I say "questionable cash flow sources," I mean items such as changes in taxes payable, tax benefits from stock options, and asset sales, among others. That's not to say that companies booking these as sources of cash flow are weak, or are engaging in any sort of wrongdoing, or that everything that comes up questionable in my graph is automatically bad news. But whenever a company is getting more than, say, 10% of its cash from operations from these dubious sources, investors ought to make sure to refer to the filings and dig in.

With 18.0% of operating cash flow coming from questionable sources, Plains All American Pipeline investors should take a closer look at the underlying numbers. Within the questionable cash flow figure plotted in the TTM period above, stock-based compensation and related tax benefits provided the biggest boost, at 5.9% of cash flow from operations. Overall, the biggest drag on FCF came from capital expenditures, which consumed 70.7% of cash from operations.

A Foolish final thought

Most investors don't keep tabs on their companies' cash flow. I think that's a mistake. If you take the time to read past the headlines and crack a filing now and then, you're in a much better position to spot potential trouble early. Better yet, you'll improve your odds of finding the underappreciated home-run stocks that provide the market's best returns.

Can your retirement portfolio provide you with enough income to last? You'll need more than Plains All American Pipeline. Learn about crafting a smarter retirement plan in "The Shocking Can't-Miss Truth About Your Retirement." Click here for instant access to this free report.

We can help you keep tabs on your companies with My Watchlist, our free, personalized stock tracking service.

Add Plains All American Pipeline to My Watchlist.U.S. Stocks Fluctuate as Investors Weigh Stimulus Timing

You need to enable Javascript to play media on Bloomberg.com

U.S. stocks declined, after the Standard & Poor's 500 Index climbed four straight weeks, as investors weighed the pace of central bank stimulus efforts amid corporate dealmaking.

Procter & Gamble Co. and Coca-Cola Co. retreated at least 1.2 percent as companies that make food, beverages and household products slumped. Yahoo! Inc. climbed 0.2 percent after agreeing to buy blogging network Tumblr Inc. for $1.1 billion. Actavis Inc. rallied 1.3 percent as it reached a deal to acquire Warner Chilcott Plc. Exxon Mobil Corp. and Chevron Corp. gained more than 0.8 percent as energy shares surged.

The S&P 500 (SPX) retreated 0.1 percent to 1,666.29 in New York after rising as much as 0.3 percent earlier. The Dow Jones Industrial Average declined 19.12 points, or 0.1 percent, to 15,335.28. About 6 billion shares traded hands today, or 5.1 percent below the three-month average.

"Some minor pullback should be expected after the steady gains we've achieved," Eric Teal, chief investment officer at First Citizens BancShares Inc., which manages $5 billion in Raleigh, North Carolina, said in a phone interview. "I don't think that we're going to see any immediate tapering off of monetary policy, though we can expect from hawkish members or others outside the FOMC questioning the policy, which might lead to market volatility."

The S&P 500 added 2.1 percent last week, its fourth straight weekly gain, as gauges of leading economic indicators and consumer sentiment beat estimates. The U.S. bull market has entered its fifth year, adding about $11.5 trillion in market value, according to data compiled by Bloomberg. The S&P 500 has surged 146 percent from a 12-year low in 2009, driven by better-than-estimated corporate earnings and three rounds of bond purchases from the Federal Reserve.

'Escape Velocity'Stocks erased gains from earlier in the session after Fed Bank of Chicago President Charles Evans said the U.S. economy has improv! ed "quite a lot" as the central bank maintains record stimulus. The question now is "how much confidence we have that the improvements that have been made will continue and be sustained," said Evans, who holds a vote on the Federal Open Market Committee this year.

Dallas Fed President Richard Fisher said in an interview on CNBC that the odds favor dialing back the central bank's purchase of $85 billion in bonds per month. He said he would have started tapering stimulus at the last FOMC meeting.

Unprecedented StimulusSome Fed officials in recent months have signaled they favor scaling back the quantitative-easing program in the next few months. Fed Chairman Ben Bernanke has said he would continue unprecedented stimulus until the jobless rate falls to 6.5 percent or inflation rises above 2.5 percent. The Fed publishes minutes of its last policy meeting on May 22, while Bernanke will testify that day on the economic outlook.

"Keep in mind we are at all-time highs so even a moderate cautious comment will be met with some selling," Larry Peruzzi, senior equity trader at Cabrera Capital Markets LLC in Boston, wrote in an e-mail. "Investors are looking for a reason to take profits."

The S&P 500 has rallied 127 days without a retreat exceeding 5 percent or more, data compiled by Bloomberg show. The index dropped 7.7 percent from a Sept. 14 peak through Nov. 15. The advance is the longest without a 5 percent drop since a 173-day stretch ended Feb. 20, 2007, about eight months before the financial crisis sent the market plunging 57 percent.

Defying Skeptics"This move in the market has defied all the skeptics," E. William Stone, chief investment strategist at PNC Wealth Management in Philadelphia, said in a phone interview. His firm manages about $117 billion. "While all of us know there will be some pullback at some point, it's hard to be the person to bet that tomorrow will be the case."

The Chicago Board Options Exchange Volatil! ity Index! (VIX), or VIX, rose 4.6 percent to 13.02 The equity volatility gauge, which moves in the opposite direction to the S&P 500 about 80 percent of the time, has slipped 28 percent this year.

The S&P 500 Consumer Staples Index retreated the most among 10 industry gauges, falling 1 percent as Procter & Gamble slid 1.2 percent to $79.09 and Coca-Cola fell 1.4 percent to $42.38.

Red Hat Inc. slipped 4.3 percent to $52.65, ending 12 days of consecutive gains. The largest seller of Linux operating-system software was cut to market perform, an equivalent of neutral, from outperform at BMO Capital Markets by equity analyst Karl Keirstead.

Energy RallyFive of the 10 S&P 500 industry groups gained, led by a 1.3 percent rally among energy producers.

Exxon Mobil rose 0.8 percent to $92.52 and Chevron added 1.1 percent to $124.78. Oil prices advanced for a fourth day as the dollar declined and turmoil in the Middle East bolstered concern that shipments from the region will be disrupted.

WPX Energy Inc. climbed 7 percent to $19.76. Taconic Capital Advisors LP disclosed a 6.39 percent stake in the natural gas and oil company and said it may seek ways to enhance shareholder value, according to a regulatory filing.

Chesapeake (CHK) Energy Corp. added 2.6 percent to $20.80. The second-biggest U.S. natural-gas producer said Robert Douglas Lawler will become chief executive officer from June 17. Lawler was senior vice president of international and deepwater operations at Anadarko Petroleum Corp., Chesapeake said.

Co-founder Aubrey McClendon, 53, stepped down as CEO of Chesapeake last month after a shareholder revolt by Carl Icahn and Southeastern Asset Management Inc.

Apple Inc. increased 2.2 percent to $442.93, climbing above its average price during the past 50 days.

Takeover DealsAbout $10.2 billion of takeovers was announced today, bringing the total value of transactions so far this year to $330.2 billion, according to data compi! led by Bl! oomberg.

Yahoo rose 0.2 percent to $26.58. The biggest U.S. Web portal is buying Tumblr as Chief Executive Officer Marissa Mayer seeks to lure users and advertisers with her priciest acquisition to date. Mayer, CEO since July, is betting that Tumblr will help transform Yahoo into a hip destination in the era of social networking as she challenges Google Inc. and Facebook Inc. in the $17.7 billion display ad market.

Actavis added 1.3 percent to $127.15 after saying it will buy Warner Chilcott for $8.5 billion in a stock transaction that enables the company to expand in women's health and urology. The combined annual revenue of the companies will be about $11 billion, according to a joint statement. Warner Chilcott, the drugmaker that unsuccessfully pursued a sale last year, increased 2 percent to $19.60.

Websense JumpsWebsense Inc. jumped 29 percent to $24.76. The Internet-security company will be acquired by private-equity firm Vista Equity Partners in a deal valued at about $906 million. Websense is trying to transition from its roots blocking inappropriate websites in the workplace into a provider of broader online-security services.

Abbott (ABT) Laboratories gained 3.3 percent to a record $37.81. The medical device and nutritional products maker was boosted to buy from neutral by Goldman Sachs Group Inc. The company has the potential to expand margins, analyst David Roman wrote in a note.

Pandora Media Inc. gained 2 percent to $16.38 as Barclays Plc raised its recommendation on the biggest Internet radio provider to equal weight, similar to hold, from underweight

Monday, May 20, 2013

Sunday, May 19, 2013

Best Media Stocks To Watch For 2014

Although we don't believe in timing the market or panicking over market movements, we do like to keep an eye on big changes -- just in case they're material to our investing thesis.

What: Shares of AVEO Pharmaceuticals (NASDAQ: AVEO ) , a cancer therapeutics company, collapsed as much as 27% following the release of briefing documents today in anticipation of AVEO's meeting with the Food and Drug Administration panel on Thursday.

So what: If you recall, one of the oddities of AVEO's Tivozanib, an oral metastatic renal cell carcinoma drug, is that it outperformed Bayer and Onyx Pharmaceuticals' (NASDAQ: ONXX ) Nexavar in terms of progression-free survival in trials (11.9 months versus 9.1 months), but actually delivered a slightly lower median overall survival than Nexavar (28.8 months versus 29.3 months). According to the briefing docs released this morning, it appears that the FDA may want AVEO to run an additional trial to confirm the added benefit of Tivozanib based on that reduction in overall median survival noted during the study.

Best Media Stocks To Watch For 2014: Sinobest Technology Hldgs Ltd. (T80.SI)

Sinobest Technology Holdings Ltd., an investment holding company, provides computer and network system integration, building integration, application software development, and technical services in the People's Republic of China. It offers e-archive management, social security allied office, public security joint approving, e-document exchange center, e-regulation and policy, e-conference, e-financial management, and performance assessment solutions for the government; and government internal Website portal, short message service, office automation, email, decision making support, information service management, and service management information solutions for public servants. The company also offers online applying and approving, and enterprise information service solutions for businesses; community service, e-Medicare, online applying and approving, public information service, e-identity verification, and hotline service solutions for public; and application support, ser vice application, and network infrastructure solutions. It primarily serves government bureaus and departments, and state-owned enterprises in the sectors of telecommunication service, power supply, railway and transportation, immigration and customs, public security, labor and social insurance, universities, land and resources, taxation and finance, and food and drugs, as well as privately-owned enterprises. The company was founded in 1997 and is headquartered in Guangzhou, the People's Republic of China Sinobest Technology Holdings Ltd. is a subsidiary of Profit Saver International Limited.

Best Media Stocks To Watch For 2014: Aguila American Resources Ltd (AGL.V)

Aguila American Resources Ltd. engages in the exploration and development of mineral properties in Peru. It primarily explores for gold and uranium. The company principally holds interest in the Angostura property comprising 9 exploration concessions and 2 claims, covering approximately 6,800 hectares located in southern Peru in the Department of Apurimac. The company was founded in 1997 and is headquartered in Vancouver, Canada.

Best Up And Coming Stocks To Buy For 2014: Meru Networks Inc.(MERU)

Meru Networks, Inc., together with its subsidiaries, provides wireless local area network (LAN) solutions in the Americas, Europe, the Middle East, Africa, and the Asia Pacific. It offers a virtualized wireless LAN solution based on its System Director Operating System, which runs on its controllers and access points to enable enterprises to deliver business-critical applications over wireless networks. The company?s System Director Operating System provides centralized coordination and control of various access points on the network; controllers synchronize access points to optimize the user experience and manage traffic on the network; and Wi-Fi certified access points to provide network connectivity for wireless devices. It also offers Meru Networks E(z)RF application suite comprising E(z)RF Network Manager, E(z)RF Service Assurance Manager, E(z)RF Location Manager, E(z)RF OnTheGo, Spectrum Manager, and wired and wireless management solutions, which enable enterprises to configure, monitor, troubleshoot, secure, and operate virtualized wireless LAN solution. In addition, the company provides Identity Manager that simplifies enterprise network access and identity management; Wireless Intrusion Prevention System to recognize and mitigate threats; Compliance Manager to reduce the risk of security breach by protecting customer and employee personal information by extending security to the wireless network; AirFirewall to intercept and block unwanted communications as they transmit over the air, stopping them before they reach the network; and Security Gateway SG1000 to meet the demands of the Federal Information Processing Standard, 140-2 Level 3 security required by federal government agencies and other security-conscious organizations. It serves the education, healthcare, hospitality, manufacturing, retail, technology, finance, government, telecom, transportation, and utility markets. The company was founded in 2002 and is headquartered in Sunnyvale, California.

Saturday, May 18, 2013

The Secret Government Project That Makes Disney Stock a Buy

Phil Coulson is back! Clark Gregg's scene-stealing S.H.I.E.L.D. agent headlines a forthcoming TV show called Marvel's Agents of S.H.I.E.L.D. for Walt Disney's (NYSE: DIS ) ABC television network. Plans have been in the works since the House of Mouse signed creator Joss Whedon to a long-term contract that includes directing 2015's Avengers 2.

Coulson is an important character. He first appeared in Iron Man and remained a constant through several of the Marvel Studios films, right up until his on-screen death in Marvel's The Avengers. Fans have been mourning him ever since, says Tim Beyers of Motley Fool Rule Breakers and Motley Fool Supernova in the following interview with the Fool's Erin Miller.

For investors, the key is that Disney is taking the Rule Breaking step of creating a universal continuity that stretches from comic books to films to television. It's an advantage that Sony (NYSE: SNE ) and News Corp. (NASDAQ: NWSA ) , despite their interests in Marvel properties Spider-Man, the X-Men, and the Fantastic Four, can't touch. Look to buy shares of Disney stock on weakness, Tim says.

Do you agree? Please watch the video to get Tim's specific take, and then let us know whether you would buy, sell, or short Disney stock at current prices.

Launch your portfolio into Tomorrowland

From its vast catalog of characters to its monster collection of media networks, much of Disney's allure for investors lies in its diversity, and The Motley Fool's premium research report lays out the case for investing in Disney today. This report includes the key items investors must watch as well as the opportunities and threats the company faces going forward. So don't miss out -- simply click here now to claim your copy today.

Friday, May 17, 2013

Is Japan's Surge Bringing Top Profits for Manufacturers?

Japan's bold new stimulus moves have set the Nikkei (NIKKEIINDICES: ^NI225 ) on fire this year, but prime minister Shinzo Abe won't stop with what he's gained so far. As the Nikkei finished up yet another week of solid gains by rising 2.5% over the past five days, Abe unveiled a new list of goals for his aggressive monetary easing plans. Strong economic data helped Japan's stocks surge this week, but what news has emerged that will impact investors?

No goal too big for Shinzo Abe

Abe outlined a number of targets for his stimulus and regulatory reforms to achieve in a speech on Friday, and the prime minister's thinking big. He hopes for transportation and power-generation exports to triple in coming years, growing total infrastructure exports to $291 billion, or 30 trillion yen, by 2020. Along with doubling tourism and farm exports, Abe's aiming for Japan to recover all its economic losses inflicted by the 2008 recession.

So far, so good under the new prime minister's plan. Japan's GDP grew at a 3.5% annualized rate in the first quarter, surpassing the U.S.'s economic growth by a full percentage point, and easily topping economist projections of 2.8% growth. It's a big improvement on last year, when Japan was still locked in contraction territory. Abe's 2% inflation goals still linger far off in the distance, but the yen recently surpassed the 100 yen per dollar mark, an important milestone, as Japan's currency pulls back from years of strength.

The weak yen is good for exporters, and Japan's leading manufacturers got a welcome surprise this week. Core machinery orders increased by more than 14% in March, and core manufacturing orders are expected to break a contraction streak in the second quarter by posting a 0.8% gain. Japanese manufacturer Komatsu (NASDAQOTH: KMTUY ) has soared on the back of the economy's surge, and the industrial giant's stock has jumped more than 13% over the past month.

Komatsu's the second-largest industrial and mining equipment manufacturer in the world after Caterpillar (NYSE: CAT ) , and the weak yen should help Komatsu maintain its market-share lead over its American rival in China. Caterpillar hopes to counter by investing more in China, including launching a new manufacturing center, but investors should love Komatsu's momentum and position, even as the industrial sector continues to remain stuck under poor conditions. The firm predicts a 46% net profit increase this year to be boosted by the falling yen and increased Chinese demand, and for a down period for the industry, that's a gain investors should celebrate.

Farm machinery and tractor manufacturer Kubota (NYSE: KUB ) also got a boost from Abe's speech, and shares are up a whopping 23% over the past month after gaining 5.2% on Friday alone. An increase in farm exports, and Japan's agricultural industry would be a boon for Kubota, particularly as the company aims to compete among the bigger players in its industry, such as Deere. Seventy percent of Kubota's sales last year came from farm and industrial equipment, and the weak yen should also help Kubota's international competitiveness.

Can Caterpillar keep up with Japan's rise?

Caterpillar might not have such a rosy outlook as Komatsu and Kubota, but this is one stock that's backed up by a solid foundation. Caterpillar is the market share leader in an industry in which size matters, and its quality products, extensive service network, and unparalleled brand strength combine to give it solid competitive advantages. Read all about Caterpillar's strengths and weaknesses in The Motley Fool's brand new report. Just click here to access it now.

Thursday, May 16, 2013

Wabtec Hikes Dividend 60% and Splits Stocks 2-1

The board of directors of railroad products manufacturer Wabtec (NYSE: WAB ) was busy yesterday, announcing it was increasing its quarterly dividend payment by 60% while simultaneously splitting the company's stock.

The board said it was raising the payout from $0.025 per share to $0.04 per share on Aug. 30 for shareholders of record as of Aug. 16. This marks the third consecutive year Wabtec has increased the dividend.

The stock split, which will be paid June 11 to shareholders of record June 3, would be a 100% stock dividend and shareholders would receive one additional share of Wabtec's stock for each share they own on the record date. It expects the stock to begin trading at the split-adjusted price on June 12.

The new dividend payment equates to a $0.16-per-share annual dividend yielding 0.1% based on the closing price of Wabtec's stock on May 14.

WAB Dividend data by YCharts.Chart does not reflect new, higher payment.

link

S&P 500 Approaches 1,600, Dow Inches Higher

Stocks crept higher again today as the S&P 500 set another record at 1,597, coming within inches of the 1,600 milestone. The Dow Jones Industrial Average (DJINDICES: ^DJI ) , meanwhile, moved up 21 points, or 0.14%, to finish at 14,840.

Economic reports were mixed as the Chicago PMI dipped into contraction range with a rating of 49.0, hitting a three-and-a-half year low. The figure was significantly coming below projections of 52.0 and down from last month's total of 52.4. Stocks fell off after the report, but began to recover after a better-than-expected consumer confidence report came out. The Conference Board said consumers' perception of the economy jumped from 59.7 last month to 68.1 in April, well ahead of expectations of just 61.0. The recovery in home prices and record-high stocks helped lift consumer sentiment.

The two contradicting reports presented a muddled message for investors trying to decipher which direction the economy is headed.

Turning to individual stocks, Pfizer (NYSE: PFE ) tumbled 4.5% after releasing earnings this morning. The drugmaker fell off as it cut guidance and turned in an EPS of $0.54 a share, a penny below estimates. Revenue, however, was down 9% from a year ago, at $13.5 billion, missing analysts' mark by about 4%. Pfizer has struggled to overcome the expiration of its patent on Lipitor, which was the world's best-selling drug for a decade. Generic competition is also eating into margins on other Pfizer brands as the company is now cutting costs to try to grow profits, and is focusing on developing very expensive drugs for limited markets and targeting China. Pfizer cut its full-year EPS forecast by $0.06 to $2.14-$2.24, and dropped its revenue forecast as well, in part due to currency translation weakness.

IBM (NYSE: IBM ) was a big gainer for the second day in a row, rising 1.7% after authorizing an additional $5 billion for share buybacks, bringing the grand total available to $11.2 billion. The tech giant also raised its quarterly dividend 12% to $0.95, giving it a yield of 1.9%. Coming a week after an earnings miss sent shares plunging 8%, IBM seems eager to fight back, gaining yesterday as well on the release of its MessageSight machine-to-machine communication software.

Staying in the tech sector, Apple (NASDAQ: AAPL ) made headlines today after issuing the biggest non-bank debt offering ever, at $17 billion. As part of a strategy to reward shareholders and lower the iPhone maker's overall cost of capital, the company is borrowing money to buy back shares, as a majority of its cash balance is located overseas and would be subject to U.S. taxes if brought home to reward investors. Apple shares jumped 2.9%, and are now up 12% in less than two weeks.

There's no doubt that Apple is at the center of technology's largest revolution ever, and that longtime shareholders have been handsomely rewarded with over 1,000% gains. However, there is a debate raging as to whether Apple remains a buy. Eric Bleeker, The Motley Fool's senior technology analyst and managing bureau chief, is prepared to fill you in on reasons to buy and sell Apple and the opportunities left for the company (and your portfolio) going forward. To get instant access to his latest thinking on Apple, simply click here now.

Wednesday, May 15, 2013

Will Flowers Foods Earn More From Wonder Bread?

Tomorrow, Flowers Foods (NYSE: FLO ) will release its latest quarterly results. The key to making smart investment decisions on stocks reporting earnings is to anticipate how they'll do before they announce results, leaving you fully prepared to respond quickly to whatever inevitable surprises arise. That way, you'll be less likely to make an uninformed, knee-jerk reaction to news that turns out to be exactly the wrong move.

Flowers isn't the largest company in the stock market, but it's a big player in the market for bread and other baked goods. Even though the industry may seem like a fairly staid corner of the market, Flowers has made some exciting strategic moves recently to bolster its growth. Let's take an early look at what's been happening with Flowers Foods over the past quarter and what we're likely to see in its quarterly report.

Stats on Flowers Foods

| Analyst EPS Estimate | $0.42 |

| Change From Year-Ago EPS | 50% |

| Revenue Estimate | $1.09 billion |

| Change From Year-Ago Revenue | 21% |

| Earnings Beats in Past 4 Quarters | 1 |

Source: Yahoo! Finance.

How will Flowers Foods fare this quarter?

Analysts have gotten more optimistic about Flowers Foods and its earnings prospects recently, having boosted their estimates for the first quarter by $0.04 and their full-year 2013 consensus by more than twice that amount. The stock has also done well, rising 20% since early February.

The big news this quarter came from its role in the bankruptcy proceedings for Hostess Brands. Flowers bid $360 million for its bread brands, including Wonder Bread and Butternut, as well as related baking assets. Yet Flowers expressed no interest in bidding on the company's iconic Twinkies and other snack cakes, and instead, Apollo Global Management (NYSE: APO ) and privately held Metropoulos bid $410 million for the right to produce and sell Hostess Cup Cakes, Zingers, Twinkies, and other cake brands. Little Debbie maker McKee Foods bid on the Drake's cake line. With no other bidders emerging, Flowers was awarded court approval for the purchase in March.

Although the Hostess acquisition was high profile, Flowers has made many similar though smaller acquisitions in recent years, taking advantage of the fragmented bakery industry to pick off targets individually with attractive buyout offers. Moreover, late last year, the company bought licensing rights for the Sara Lee brand in California, after Sara Lee changed its name to Hillshire Brands (NYSE: HSH ) and shifted its focus toward meat products. The move helped Sara Lee reap more money from its brand while giving Flowers more market share in the important California market.

The key for Flowers going forward will be to avoid the high food costs that have plagued some fellow bakers. Restaurant-bakery operator Panera Bread (NASDAQ: PNRA ) managed to avoid some of the impact of high input costs by producing its own dough, but Flowers will need to secure equally stable supplies or else hope for more favorable weather conditions to prevail this season.

In Flowers' earnings report, watch for the company to show more about what the impact of gaining the Wonder Bread brand will have on sales and profits. Right now is an exciting time for Flowers, and what it does with this opportunity will define its future for years to come.

Flowers has an exciting opportunity, but in the case of Panera Bread, there's also reason to believe that the best is yet to come. The stock has been on an absolute tear over the past five years, and you're invited to find out why -- and what else there is to look forward to -- in The Motley Fool's brand-new premium report on Panera. Included are key areas that investors must watch, as well as opportunities and threats facing the company both today and in the long term. Don't miss out on this invaluable investor's resource -- simply click here now to claim your copy today.

Click here to add Flowers Foods to My Watchlist, which can find all of our Foolish analysis on it and all your other stocks.

#pitch{ display: none; }Tuesday, May 14, 2013

Top Gas Companies To Invest In Right Now

The state of Florida is increasingly turning away from fuel oil power plants, replacing them with facilities that run on cheap and plentiful natural gas instead. Though the falling price of domestic coal may make it competitive again in certain regions of the country, transportation costs to the Southeast, combined with the region's efficient natural gas power plants, indicate that this will be a strong market for the commodity for years to come. In this video, Fool.com contributor Aimee Duffy looks closely at this trend, and offers up the least risky way investors can take advantage.

It's easy to forget the necessity of midstream operators that seamlessly transport oil and gas throughout the United States. Kinder Morgan is one of these operators, and one that investors should commit to memory due to its sheer size ��it's the third-largest energy company in the U.S. ��not to mention its enormous potential for profits. In The Motley Fool's premium research report on Kinder Morgan, we break down the company's growing opportunity ��as well as the risks to watch out for ��in order to uncover whether it's a buy or a sell. To determine whether this dividend giant is right for your portfolio, simply click here now to claim your copy of this invaluable investor's resource.

Top Gas Companies To Invest In Right Now: Essential Energy Services Ltd (ESN.TO)

Essential Energy Services Ltd., together with its subsidiaries, provides oilfield services that are related to the ongoing servicing of producing wells and new drilling activity for oil and gas producers in western Canada and Colombia. The company operates in two segments, Well Servicing, and Downhole Tools and Rentals. The Well Servicing segment offers well completion and production/workover services through its fleet of coil tubing rigs, nitrogen and fluid pumpers, service rigs, rod rigs, and hybrid drilling rigs. As of March 12, 2012, it had a fleet of 49 coil tubing rigs, 10 nitrogen pumpers, 15 fluid pumpers, 57 service rigs, 14 rod rigs, and 5 hybrid drilling rigs in Canada; and 2 coil tubing rigs, 2 nitrogen pumpers, 2 service rigs, and 3 rod rigs in Colombia. The Downhole Services and Rentals segment engages in the sale and rental of downhole tools, including the Tryton MSFS, retrievable and permanent packers, flow control accessories, liner hanger systems, bridge plugs, casing scrapers, cement retainers, and selective/straddle simulation tools for completion, production, and workover projects. This segment is also involved in the rental of oilfield equipment comprising drill pipe, heavy weight pipe, collars, degassers, blowout preventer rams, spools, pipe racks, handling tools, stabilizers, and reamers. Essential Energy Services Ltd. is headquartered in Calgary, Canada.

Top Gas Companies To Invest In Right Now: Cotton #2(CT)

Capital Trust, Inc., a real estate investment trust, operates as a real estate finance and investment management company that provides credit sensitive financial products in the United States. The company?s investment programs focus on loans and securities backed by commercial real estate assets, including mortgage loans, property and corporate mezzanine loans, commercial mortgage backed securities, and subordinate mortgage interests. Its balance sheet investments include various types of commercial mortgage backed securities and collateralized debt obligations or securities, and commercial real estate loans and related instruments. The company qualifies as a real estate investment trust for federal income tax purposes. It generally would not be subject to federal corporate income taxes if it distributes at least 90% of its taxable income to its stockholders. Capital Trust, Inc. was founded in 1966 and is headquartered in New York, New York.

10 Best Up And Coming Stocks To Buy For 2014: ING Group N.V. (ISG)

ING Groep N.V., a financial services company, provides banking, investment, life insurance, and retirement services for individuals, families, small businesses, corporations, institutions, and governments worldwide. The company provides savings accounts, mortgage loans, consumer loans, credit card services, and investment products, as well as current account services and payments systems; life and non-life insurance products; asset management products and services; mortgage products; and risk management services. It also offers commercial banking products and services, including lending products, such as structured finance; payment and cash management, and treasury services; and specialized and trade finance, derivatives, corporate finance, debt and equity capital markets, leasing, factoring, and supply chain finance. In addition, the company provides individual endowment, and term and whole life insurance products, as well as traditional, unit-linked, and variable annuity life insurance products for individual and group customers; fire, motor, disability, transport, accident, and third party liability insurance products; employee benefits products and pension funds; retirement services, fixed annuities, mutual funds, and broker-dealer services; and disability insurance products and complementary services for employers and self-employed professionals comprising dentists, general practitioners, and lawyers. Further, the company offers investment management services. ING Groep N.V. operates a network of approximately 280 branches in the Netherlands; and 773 branches in Belgium. The company was founded in 1991 and is headquartered in Amsterdam, the Netherlands. ING Groep N.V. is a subsidiary of Stichting ING Aandelen.