Equities research analysts predict that Nordson Co. (NASDAQ:NDSN) will post $549.93 million in sales for the current quarter, according to Zacks Investment Research. Eight analysts have made estimates for Nordson’s earnings, with estimates ranging from $541.50 million to $555.70 million. Nordson reported sales of $496.14 million during the same quarter last year, which indicates a positive year-over-year growth rate of 10.8%. The business is scheduled to report its next earnings results on Monday, August 20th.

Equities research analysts predict that Nordson Co. (NASDAQ:NDSN) will post $549.93 million in sales for the current quarter, according to Zacks Investment Research. Eight analysts have made estimates for Nordson’s earnings, with estimates ranging from $541.50 million to $555.70 million. Nordson reported sales of $496.14 million during the same quarter last year, which indicates a positive year-over-year growth rate of 10.8%. The business is scheduled to report its next earnings results on Monday, August 20th.

According to Zacks, analysts expect that Nordson will report full year sales of $2.28 billion for the current financial year, with estimates ranging from $2.26 billion to $2.32 billion. For the next fiscal year, analysts anticipate that the company will post sales of $2.38 billion per share, with estimates ranging from $2.32 billion to $2.45 billion. Zacks Investment Research’s sales calculations are an average based on a survey of sell-side research firms that follow Nordson.

Get Nordson alerts:Nordson (NASDAQ:NDSN) last announced its quarterly earnings data on Monday, May 21st. The industrial products company reported $1.56 earnings per share for the quarter, beating the consensus estimate of $1.43 by $0.13. Nordson had a return on equity of 28.97% and a net margin of 16.63%. The business had revenue of $553.70 million during the quarter, compared to analyst estimates of $551.98 million. During the same period in the prior year, the company earned $1.35 earnings per share. Nordson’s revenue was up 11.6% compared to the same quarter last year.

NDSN has been the subject of a number of analyst reports. Wells Fargo & Co set a $135.00 price target on Nordson and gave the stock a “hold” rating in a report on Wednesday, May 23rd. Zacks Investment Research raised Nordson from a “hold” rating to a “buy” rating and set a $148.00 price target for the company in a report on Wednesday, May 16th. BidaskClub lowered Nordson from a “buy” rating to a “hold” rating in a report on Wednesday, May 2nd. B. Riley cut their price target on Nordson from $175.00 to $165.00 and set a “buy” rating for the company in a report on Wednesday, May 23rd. Finally, ValuEngine lowered Nordson from a “buy” rating to a “hold” rating in a report on Friday, April 27th. Nine analysts have rated the stock with a hold rating and seven have issued a buy rating to the company. The company presently has an average rating of “Hold” and a consensus price target of $153.60.

Hedge funds have recently modified their holdings of the stock. Advisory Services Network LLC raised its position in shares of Nordson by 972.7% in the fourth quarter. Advisory Services Network LLC now owns 1,062 shares of the industrial products company’s stock worth $155,000 after buying an additional 963 shares in the last quarter. CI Global Investments Inc. raised its position in shares of Nordson by 1,721.4% in the first quarter. CI Global Investments Inc. now owns 1,275 shares of the industrial products company’s stock worth $174,000 after buying an additional 1,205 shares in the last quarter. Sapphire Star Partners LP purchased a new stake in shares of Nordson in the fourth quarter worth $212,000. Sequoia Financial Advisors LLC purchased a new stake in shares of Nordson in the fourth quarter worth $213,000. Finally, MML Investors Services LLC purchased a new stake in shares of Nordson in the fourth quarter worth $214,000. Institutional investors own 66.24% of the company’s stock.

Nordson stock opened at $130.49 on Friday. Nordson has a one year low of $107.16 and a one year high of $151.84. The company has a debt-to-equity ratio of 0.96, a current ratio of 1.84 and a quick ratio of 1.31. The firm has a market capitalization of $7.58 billion, a PE ratio of 24.30, a P/E/G ratio of 1.66 and a beta of 1.27.

The firm also recently disclosed a quarterly dividend, which was paid on Tuesday, June 12th. Investors of record on Tuesday, May 29th were given a $0.30 dividend. The ex-dividend date was Friday, May 25th. This represents a $1.20 dividend on an annualized basis and a dividend yield of 0.92%. Nordson’s dividend payout ratio (DPR) is presently 22.35%.

About Nordson

Nordson Corporation engineers, manufactures, and markets products and systems to dispense, apply, and control adhesives, coatings, polymers, sealants, biomaterials, and other fluids. Its Adhesive Dispensing Systems segment provides dispensing, coating, and laminating systems for adhesives, lotions, liquids, and fibers to disposable products and roll goods; and product assembly dispensing, coating, and laminating systems for use in paper and paperboard converting applications, as well as for the manufacture of roll goods.

Get a free copy of the Zacks research report on Nordson (NDSN)

For more information about research offerings from Zacks Investment Research, visit Zacks.com

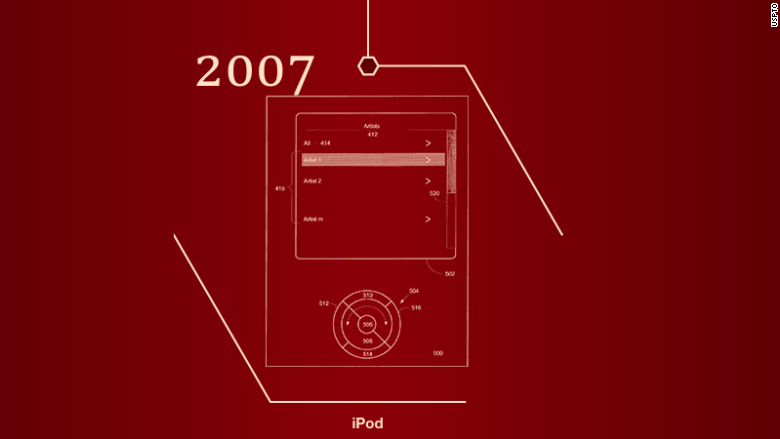

Apple's late CEO Steve Jobs received U.S. patent number 7,166,791 for a "graphical user interface" for the iPod.

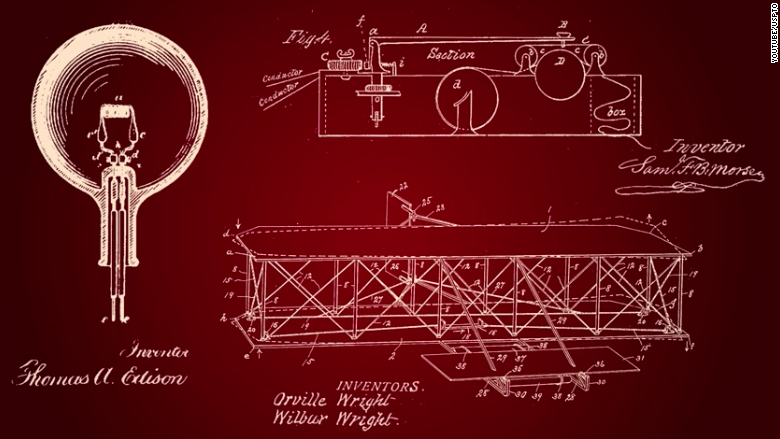

Apple's late CEO Steve Jobs received U.S. patent number 7,166,791 for a "graphical user interface" for the iPod.  Several classic patents, including Wilbur and Orville Wright's patent for a "Flying Machine."

Several classic patents, including Wilbur and Orville Wright's patent for a "Flying Machine."