There is an American idiom, "waiting for the other shoe to drop," meaning to wait for something you expect to happen, that appears to have its origins in New York City's tenement apartments of the turn of the 20th century. When someone heard the sound of an upstairs neighbor dropping a shoe on the floor, the assumption was that even though it couldn't be seen, there would be another sound matching the first before too long. It is usually used now in the sense of awaiting some unpleasant news, as in "Arconic's shares fell by 17% when 2018 guidance was revised; is another shoe going to drop?"

Arconic (ARNC), the split-off from Alcoa (AA) that was meant to be the growth company with its value-add manufacturing and engineering, really took it on the chin (to use another idiom) after announcing Q1 results that generally exceeded expectations but guided to lower EPS for 2018.

ARNC data by YCharts

ARNC data by YCharts

Shares did sell off sharply, and have not recovered meaningfully, in spite of one upgrade released after the sell-off, and another bank's view that the extent of the selling was not justified, even though lowering its own price target.

Is this a classic opportunity to pick up a mismatch between price and value, when market sentiment has relieved Arconic of 40% of its market cap since the year started? When I wrote about the company in January, I shared my view that

Given how the shares sold off after the last earnings report [referring to Q3 2017], I anticipate that even a mild miss on the next one will send them tumbling once again. Alternatively, any positive surprise on earnings would have to be substantial to really push the stock a good deal higher in the near term, and I don't expect a debt rating upgrade soon. I will definitely continue to watch the name and keep an eye out for opportunities to re-enter.

So I have followed my own advice and re-entered a long position a couple of different times, as I had not anticipated this large of a price drop, but over 3 purchases I've averaged down to under $20, but have no immediate plans to add to my position.

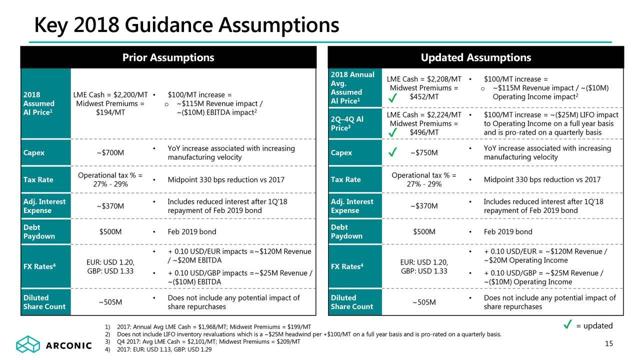

The tariff effectSo what is driving the change in guidance? To sum it in a single word, it's all about tariffs. Tariffs on aluminium, to be specific, are naturally resulting in higher input costs, and the effects that those tariffs are having are negative on Arconic's operating margins. To be sure, some operational issues are having a negative impact as well, especially in the rings and discs area acquired from Firth Rixon, and management is attempting to take steps to address those shortcomings. But on the aluminium pricing, management kindly put together a slide showing what assumptions had changed from Q4 2017 to Q1 2018, and the prices for aluminium were the key driver.

Arconic Earnings Slides

Arconic Earnings Slides

The canny observer might raise a question here - isn't it true aluminium prices actually have fallen since the tariffs were announced? Why, yes indeed the spot price for the commodity did fall, but Arconic is pointing to the Midwest Premium price, which has shot up between reporting year-end 2017 and Q1 2018 [for anyone interested, here is a 2017 study published by NERA Economic Consulting on the possible impacts of aluminium tariffs on the US economy].

Arconic's management addressed the impact at some length on the call, and picking out just one or two things to highlight would be tough, but CFO Ken Gaicobbe's statement near the end of his prepared remarks seems to capture the effect well enough (emphasis added):

Finally, I would like to give you some context on aluminum price impact to our updated 2018 guidance. As the company with a large U.S. presence, we utilize LIFO accounting to a greater extent than our comparable companies. Therefore the increasing volatility in aluminum prices will impact results to a greater degree, both on the upside when aluminum prices go down and on the downside when aluminum prices increase. . . While we have historically said that LIFO and metal lag tend to offset overtime, this statement assumes metal price rises and falls through a cycle. . . Moreover, our updated 2018 guidance assumes that current prices will hold at these elevated levels. . . Should aluminum prices decline, there would be a positive impact to our guidance.

Given the updated guidance for the rest of 2018, the market's reaction might be justified, but only if the higher aluminium prices stay that way for a long time to come. But I think buying shares now can easily be justified along the lines of expecting that the tariffs, or at least the high Midwest Premium price, will not last forever. How long is anyone's guess, but I take it as a near certainty that they'll be reversed eventually, whether Trump wins in 2020 or not. When the tariffs are lifted, if management has succeeded in other areas of making Arconic a leaner operation, then the combined effect of more efficient operations and lower aluminium prices could create a swift uptrend for shares.

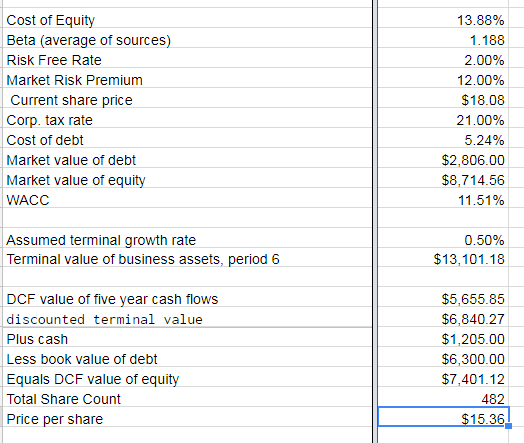

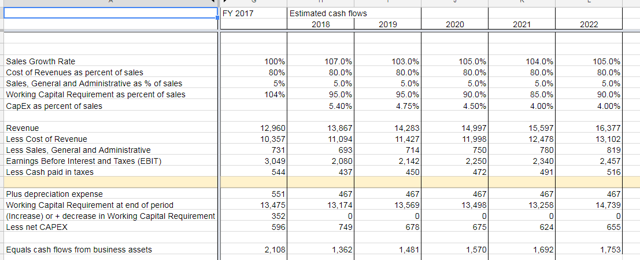

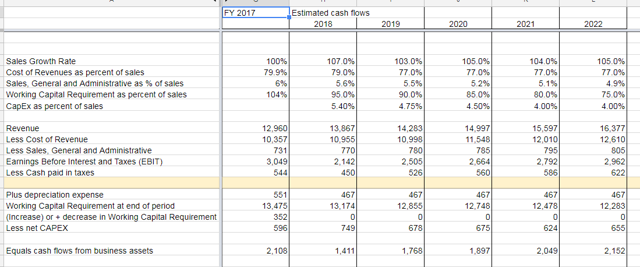

ValuationIn my discounted cash flow [DCF] model for valuing Arconic, under the current circumstances, the share price winds up in a fair value range between $15 and $19, squarely supporting where it is trading now.

However, that is assuming that the current gross margins will not change, keeping the cost of goods sold in line at 80%, and fluctuating slightly on the revenue growth and SG&A amounts, and relatively modest assumptions about top line growth (7% in 2018, which is to midpoint of guidance, and between 3% and 5% over the following 4 years).

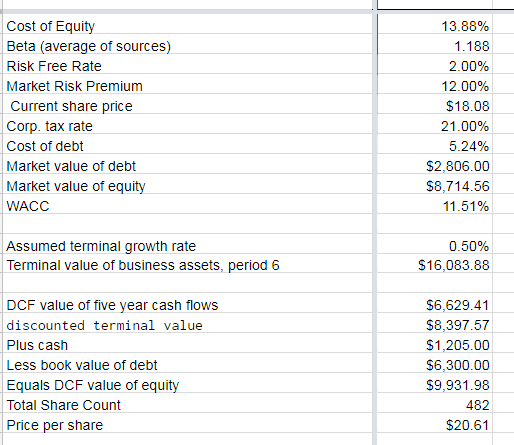

However, if gross margins can expand 200 basis points over the next few years, and SG&A is kept in check, then fair value comes in closer to $21 per share, a 16% bump from the current $18 share price, everything else in the assumptions remaining pretty constant. [Note: I chose for this model to zero out changes in working capital requirements, which I find difficult to accurately forecast. Part of Arconic's finished goods inventories are in transition from some older jet engine models to new models, while raw materials will reflect the lower costs of aluminium purchased earlier from using the LIFO method. While I generally assume that cash tied up in working capital will remain in the ~$13 million plus range, the changes year over year are not feeding into the final cash flow figure].

So if the tariffs are revoked and consequently the prices on aluminium comes down again, it is certainly conceivable that Arconic could generate some margin improvements, and not give it all back in the pricing of its products. Given the degree of reasonably robust demand that management expects, I suspect the revenue figures projected are on the conservative side. If they turned out to be higher than I have presented them here, then the benefit of improved margins should certainly flow to the bottom line.

A Word on Debt and Pensions

In a context with guidance cutting in half the free cash flow projected for this year from the original figures ($250 million compared to original guidance of $500 million), both the long-term debt and pension obligations deserve at least a mention. In Q1 2018, the company redeemed its $500 million note due 2019. From its filings, there is an additional 2019 convertible note with principle of $400 million, which if converted would be at a valuation of over $28 per share, so at the moment I would say that conversion doesn't look likely. Beyond 2019, a $1.0 billion note matures in 2020, $1.25 billion in 2021, and another $1.25 billion in 2024, with a $627 million note tucked in between for 2022, and the some other notes further out. The upcoming maturities greater than $1 billion in 2020 and 2021 are the most concerning ones. I take for granted that these will need to be refinanced in whole or in part, although quite possibly at higher coupon rates due to the Moody's downgrade since its last major bond sale; its coupon rates are already pushing 6%.

On a side note, the company does have approval for up to $500 million in share repurchases, of which none was spent in Q1. I have not been able to find public pricing information on Arconic's bonds, but I think an argument can be made that buying back debt instead of shares would be a more prudent use of capital, a view shared by Moody's headline "Arconic Inc.: Share repurchase program announcement credit negative, but ratings unaffected" [the report is part of Moody's premium content]. Given the Moody's downgrade on Arconic's long-term debt to Ba2 [slightly speculative grade] back in November 2016 and no change to ratings since then, I consider it likely that the debt could be redeemed below par.

As for pensions, the company has made moves to reduce future pension obligations with its freeze taking effect last year and some stepped-up contributions. In Q1 2018, Arconic paid in a total $177 million, compared to $53 a year ago, which by their math, when combined with the freeze, reduces liabilities by some $315 million. Clearly, this is to the good the book value of equity, but I will be interested to see how much cash Arconic continues to put in over time as the effects of the freeze slowly work their way onto the balance sheet.

ConclusionsIt is a bit of ironic twist with Arconic: Part of the premise behind splitting the old Alcoa into two, a value-add business and the commodity business, was to give investors the ability to realize the growth potential in the value add. Old management seemed to feel that the market did not properly value the combined Alcoa, treating it as primarily a commodity company. Now, here we are in 2018 and one of the primary drivers in Arconic's value is the price of the commodity.

If you believe that the price of aluminium is likely to remain at elevated levels for a substantial time, then Arconic may not fit in your portfolio. However, in my view, the historical trend is that American tariffs are somewhat cyclical - they come for a while and go. And in this case, when that shoe drops, I fully expect Arconic's share to appreciate nicely.

Disclosure: I am/we are long ARNC.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

No comments:

Post a Comment